GoCashless

How it works

-

Attendees receive an NFC wristband (or QR pass) during ticketing or event check-in. Each wristband is linked to a secure digital wallet.

Guests can top-up their wristbands at self-service stations, mobile top-up agents, or via online preloading before the event.

From entry gates to food stalls and merchandise vendors, attendees simply tap their wristband on a GoCashless device — fast, secure, and card-free.

Organizers can track spend per user, limit budgets, monitor vendor activity, and manage wallets live from the dashboard.

Generate full event reports including vendor sales, attendee spending trends, peak hours, top categories, and settlement summaries.

-

Event Budgeting: Event organizers set a budget for the event, determining how much to allocate to each attendee for food, drinks, or other services.

Digital Wallets or Event Accounts: Each attendee is assigned a digital wallet or event-specific account. Organizers pre-load these accounts with the allocated amount or give attendees instructions on how to load funds if they choose to add more.

Access to Funds: Attendees receive QR code or wristband, linked to their digital wallet, allowing them to pay for food, drinks, and services with just a scan.

Secure Payment Method: Payment devices or app credentials are encrypted and unique, ensuring only authorized users can access their funds.

Contactless Payment Points: Vendors, bartenders, or staff at the event are equipped with contactless payment devices or mobile devices that can scan QR codes or read coded wristbands.

Instant Transactions: Each transaction is processed instantly, deducting the amount from the attendee's account. This makes for quick service, reduces lines, and keeps the event flowing smoothly.

Spending Analytics: Event organizers have real-time access to spending data, which allows them to track how much each attendee or group has spent and monitor the overall budget.

Adjustments on the Go: If more funds are needed or if an attendee has exceeded their limit, organizers can make adjustments in real-time through the platform.

Detailed Reports: After the event, organizers can access detailed reports that show spending patterns, which vendors were most popular, and how the allocated budget was used.

Automatic Reconciliation: With all transactions tracked digitally, reconciliation is straightforward, saving time in closing out the event.

Why Go Cashless?

Why Event Organizers Love GoCashless

Our Cashless Payment system is designed to make events smoother, safer, and more enjoyable for both you and your guests.

-

Speed & Convenience

Cashless tap-to-pay speeds up every transaction, cutting queues at entrances and vendor stalls for a faster, smoother overall event experience.

-

Secure & Theft-Proof

No cash handling, no theft risk, and every transaction is logged and traceable.

-

Corporate Spend Optimization

Set a budget and monitor spending in real-time to keep costs in check.

-

Increases Average Spend

Preloaded wallets often result in higher spend per attendee, boosting event revenue.

-

End-to-End Cashless Support

From ticketing to reconciliation — we handle the entire cashless experience so you can focus on running an amazing event.

GoCashless delivers a complete cashless ecosystem designed for smooth, secure event payments.

GOCASHLESS

Features

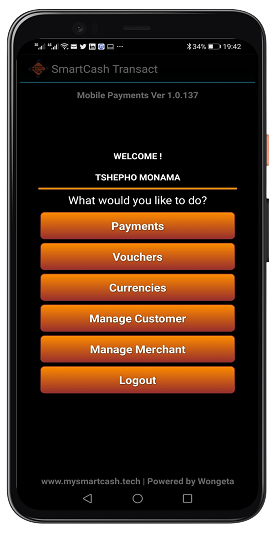

Download our Mobile App

Download our mobile app

Vendors use our app to take cashless payments instantly

-

Quick Setup & Easy Installation

Vendors can download and install our mobile POS app on any NFC-enabled Android smartphone, allowing them to start accepting cashless wristband payments within minutes—no complicated setup or extra hardware required.

-

Faster Transactions & Increased Sales

The app enables instant tap-to-pay transactions, reducing queue times and keeping customers moving. Faster transactions mean vendors can serve more customers, increasing revenue opportunities during the event.

-

Simplified Payment Tracking & Reporting

Vendors get real-time sales data and digital receipts directly in the app. This makes reconciliation easier, helps manage inventory, and provides insights into top-selling items, all without manual paperwork.